COMMON REMITTING / PAYROLL AGGREGATION SERVICE

STREAMLINE YOUR PAYROLL PROCESS

Administer a Multiple Employer Plan (MEP), Pooled Employer Plan (PEP), or Group of Plans (GOP) without getting involved in payroll and contribution submission. Recordkeepers require a Common Remitter / Payroll Aggregator to submit contribution files received by multiple payroll vendors within an MEP / PEP / GOP 401(k) plan. 360 Payroll Integration serves as the Common Remitter / Payroll Aggregator for you and your MEP / PEP / GOP. Files are uploaded to our secure server, and remitted to the recordkeeper in a timely manner. Confirmation of receipt and deposit are stored with 360 Payroll Integration for use with auditors if needed on a per adopter, per payroll basis.

We can also incorporate our 180 or full 360 payroll integration service to include deferral and loans. This option will streamline contribution reporting, providing further incentive for joining your MEP / PEP / GOP.

WHY CHOOSE US AS YOUR COMMON REMITTER / PAYROLL AGGREGATOR?

1. We track pay cycle to ensure timely remittance of contribution files.

2. Since we are not a TPA, we'll never compete with you or take your administration business.

3. We are not advisors, and we'll never shop the plan.

4. We are solely focused on payroll aggregation and common remitter services.

PAYROLL 180 SERVICE

SAVE TIME, REDUCE YOUR RISK & ENJOY PEACE OF MIND

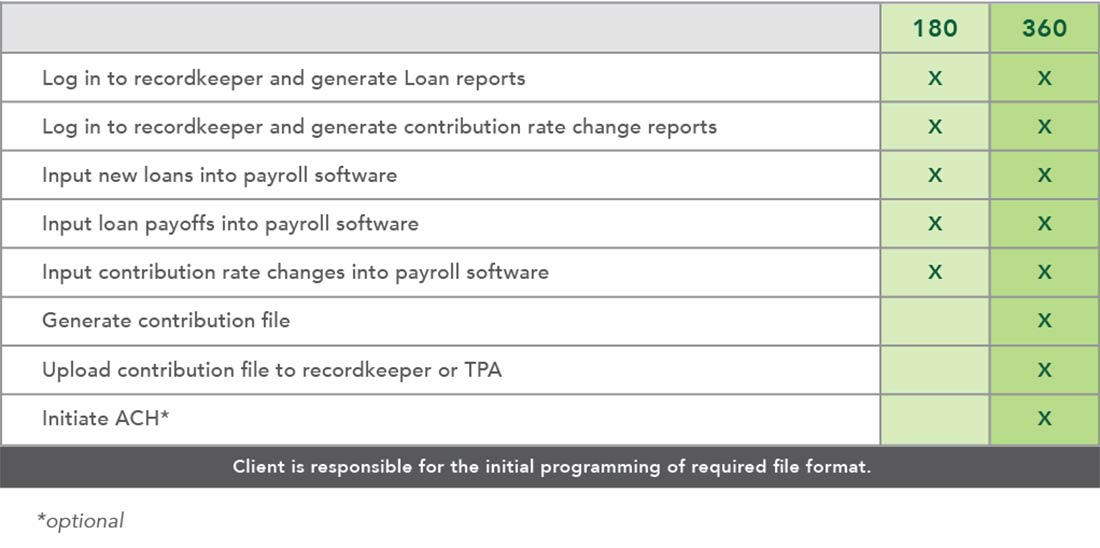

Our Payroll 180 service eliminates the need for you to manually enter deferral changes and loan information into your payroll software, saving you time and ensuring up-to date records.

We help you avoid missing employee rate change requests and loans and ensure changes made by employees on the recordkeeper website are entered into your payroll sofware accurately and in a timely manner. Payroll 180 allows you to focus on other job functions by removing repetitive and time-consuming administrative 401(k) tasks from your plate.

We can also incorporate our full 360 payroll integration to include preparation and submission of your payroll contribution files each pay period.

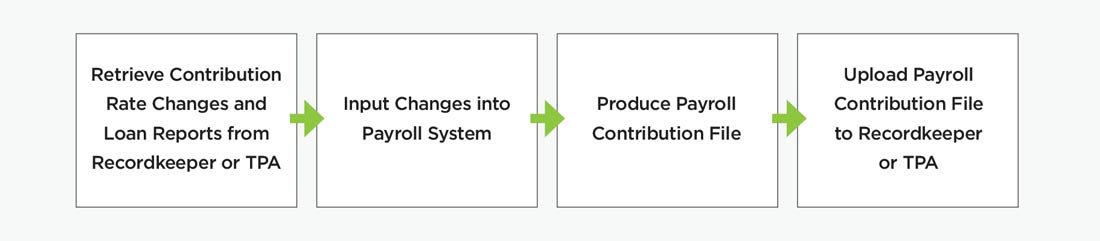

LET US MAKE YOUR PAYROLL PROCESS EASY...

1. Monitoring contribution rate changes

2. Tracking new loan requests and loan payoffs

3. Inputting these changes into your payroll system

PAYROLL 360 SERVICE

ENSURE TIMELY SUBMISSIONS & AVOID PENALTIES

According to the DOL, since inception of the Voluntary Fiduciary Correction Program in 2000, 90% of applications were due to delinquent contribution/payroll submission. Late contributions are reported on your 5500 (or the MEP’s 5500). You may have to pay Lost Opportunity Costs and/or be subject to a DOL audit.

You outsource most of your 401(k) responsibility and liability, why not outsource contribution reporting as well? 360 Payroll Integration will save you time and prevent you from being fined for late contributions.

REDUCE YOUR WORKLOAD & MAINTAIN COMPLIANCE

1. Retain your current payroll company

2. Ensure timely submissions & keep files accurate and up to date

WE REALIZE YOU HAVE TO PERFORM MANY FUNCTIONS ON A DAILY BASIS...

OUR ONLY FOCUS IS SUBMITTING YOUR 401(k) PAYROLL ACCURATELY AND IN A TIMELY MANNER.

COMPARING PAYROLL SERVICE LEVELS

WHICH SERVICE IS RIGHT FOR YOU?

Please contact us to learn more about our services and pricing.